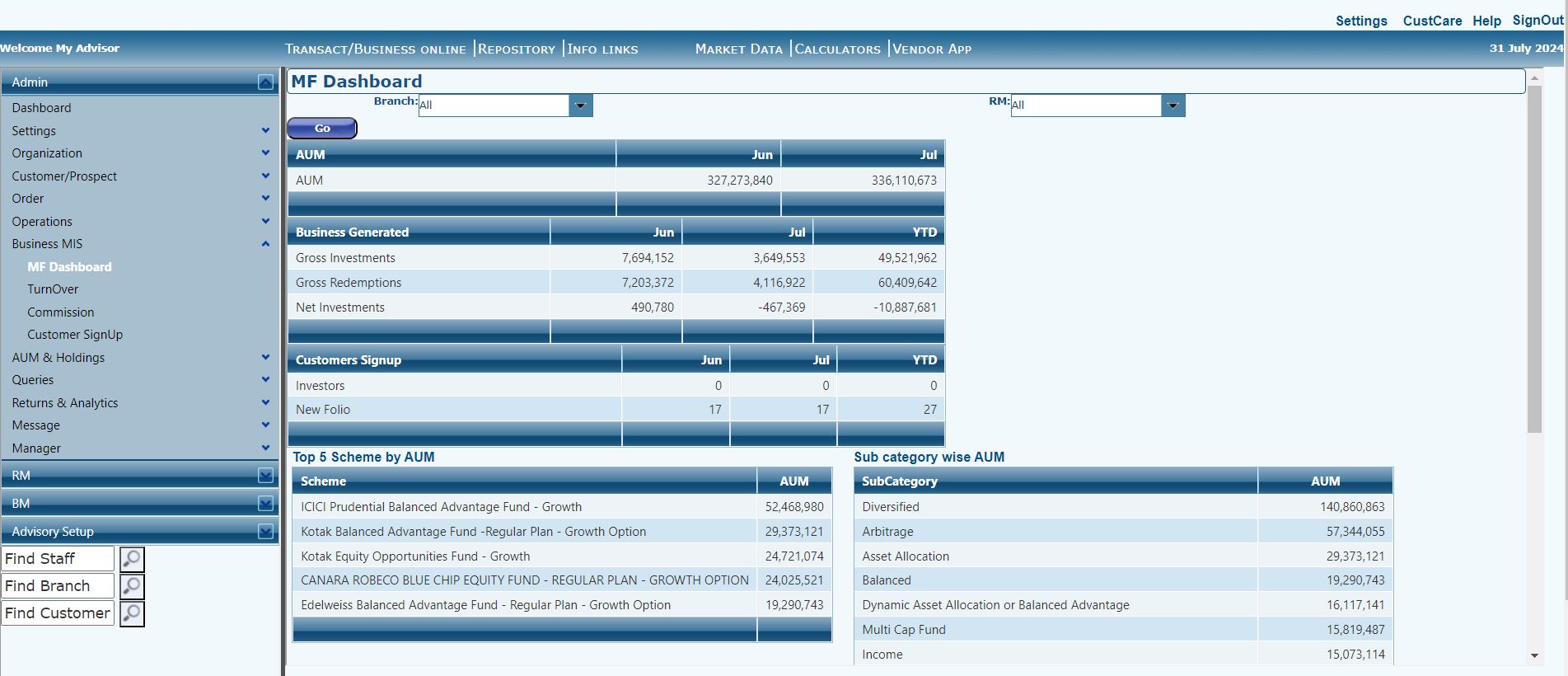

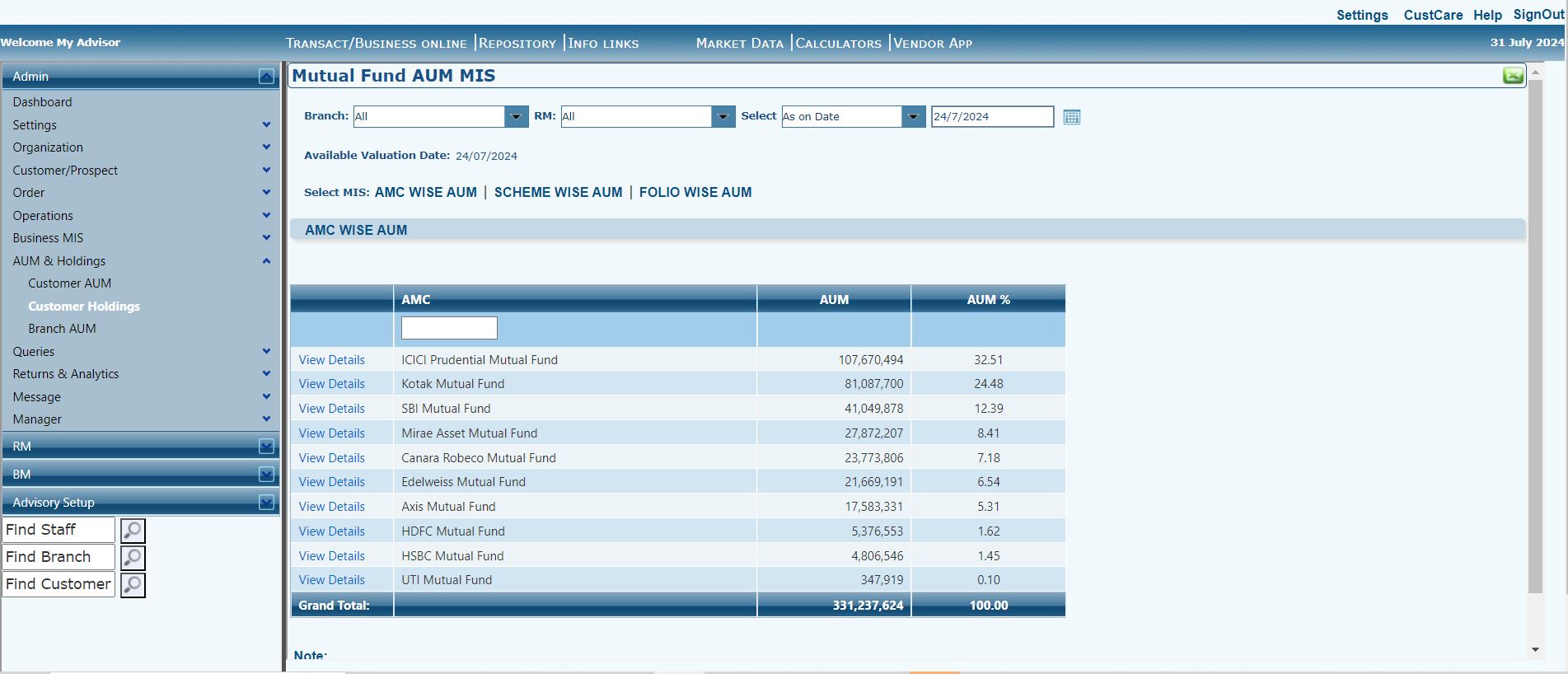

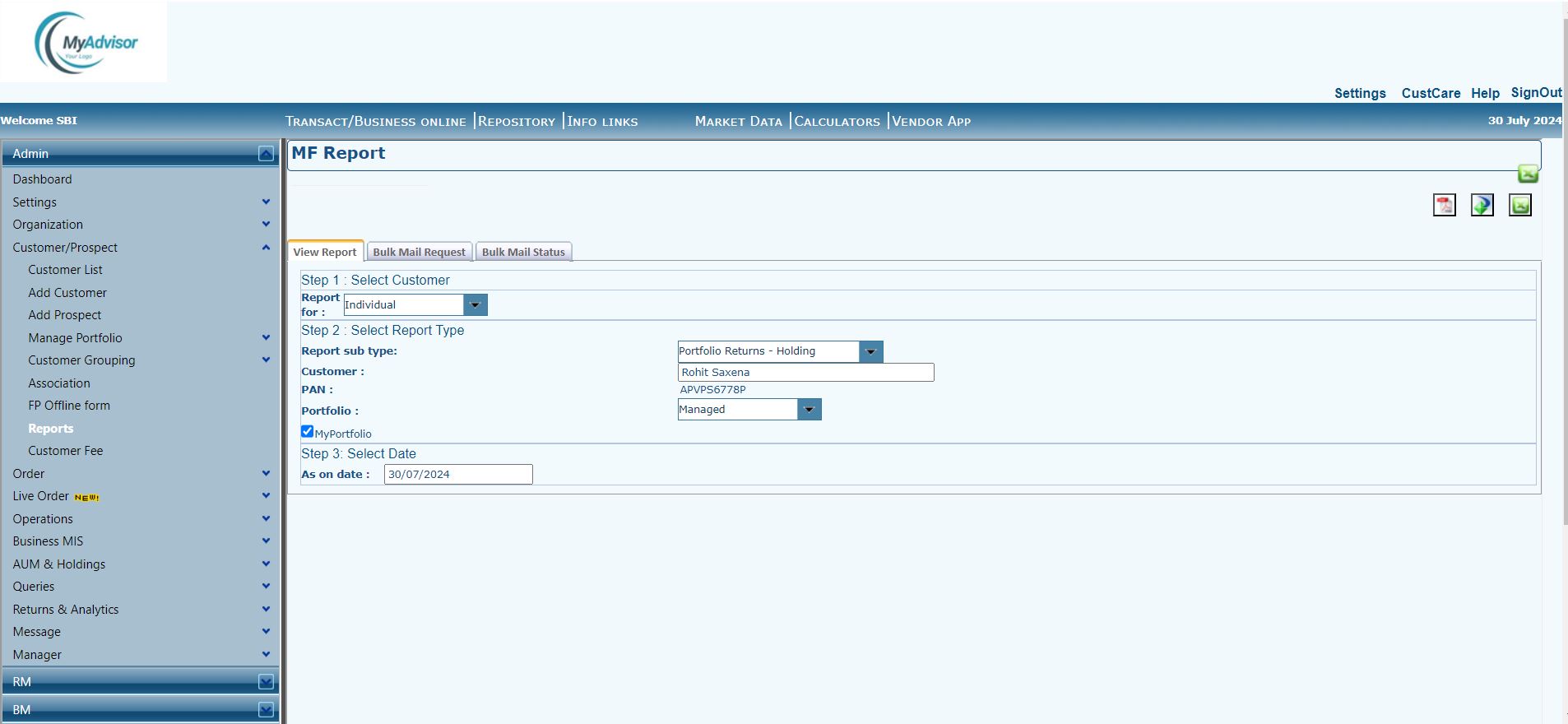

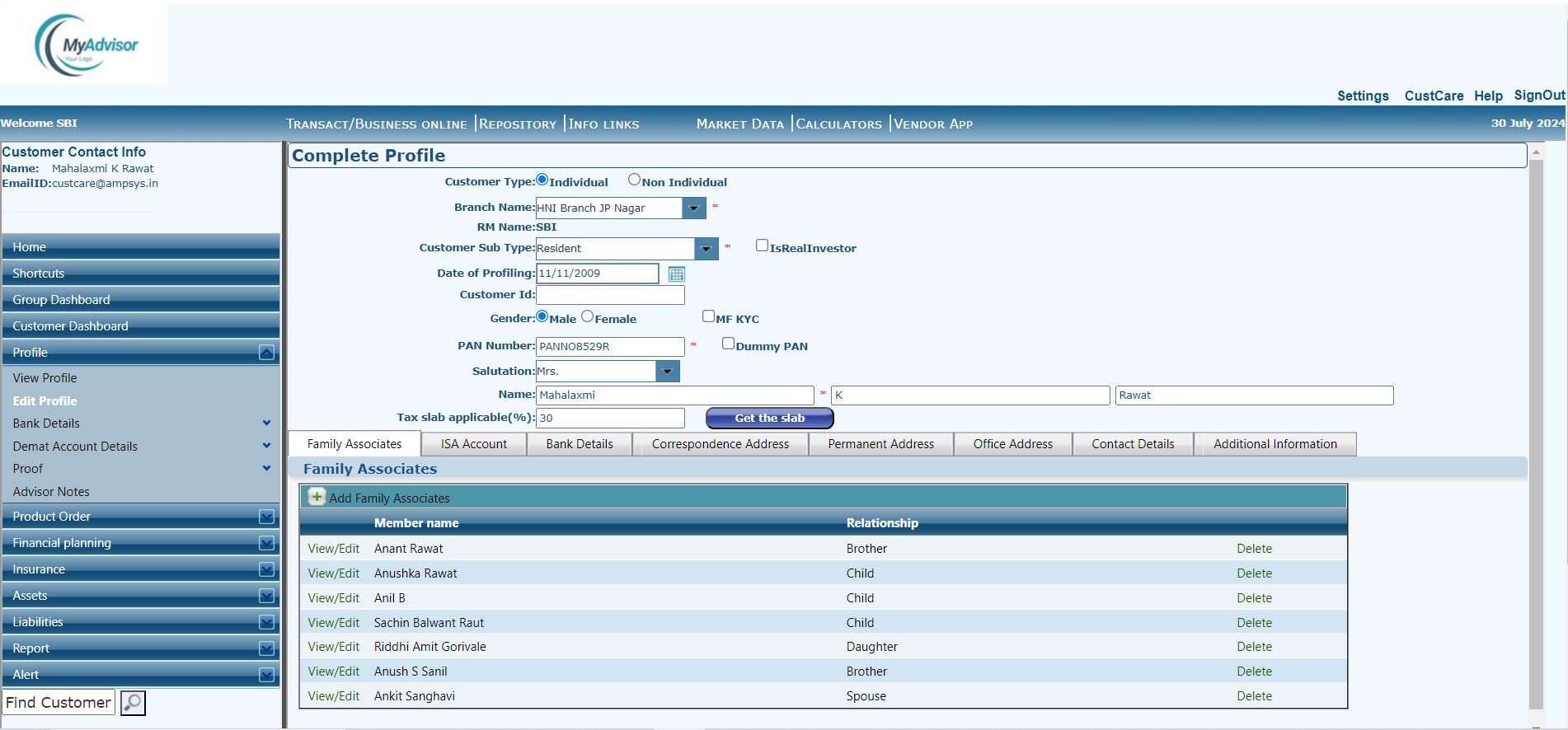

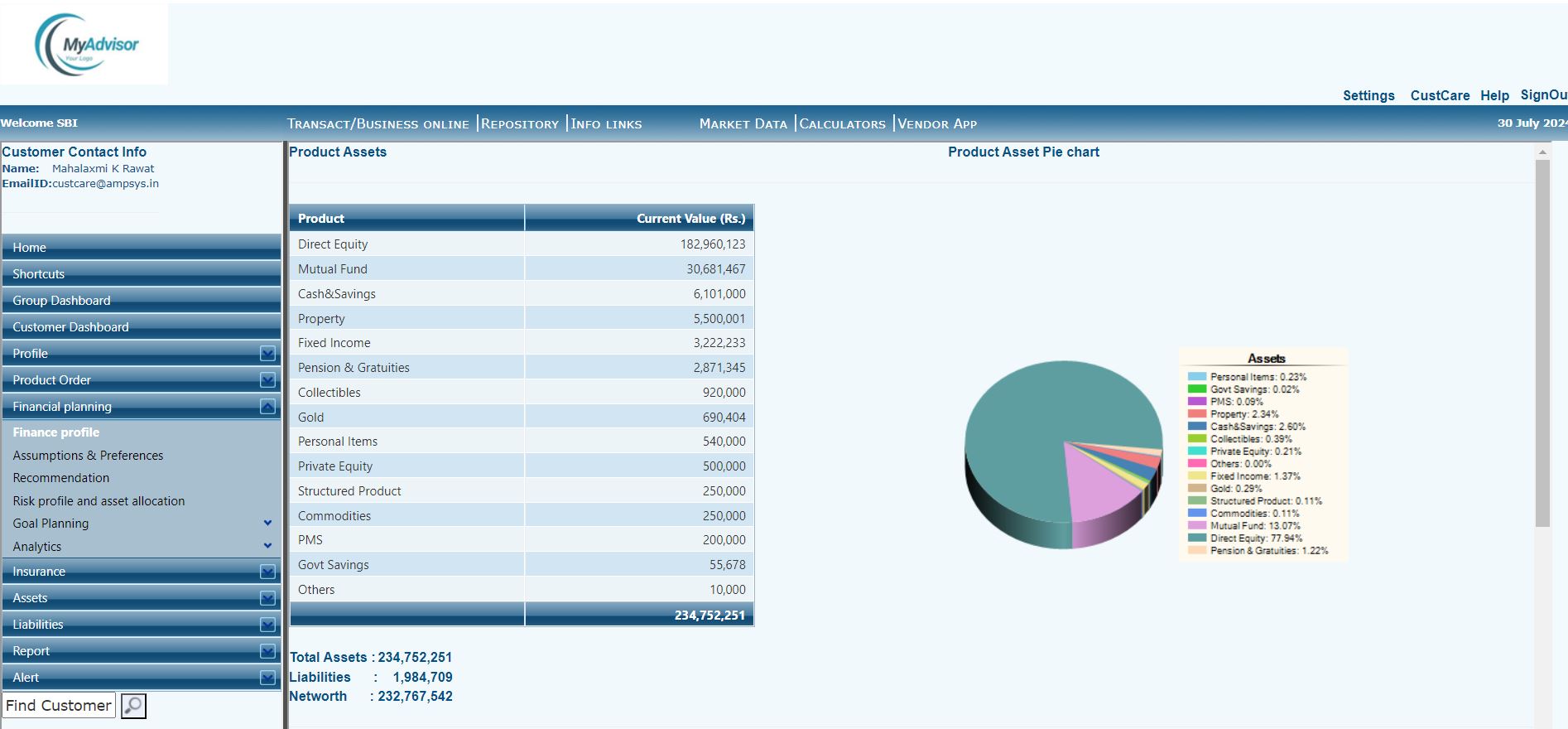

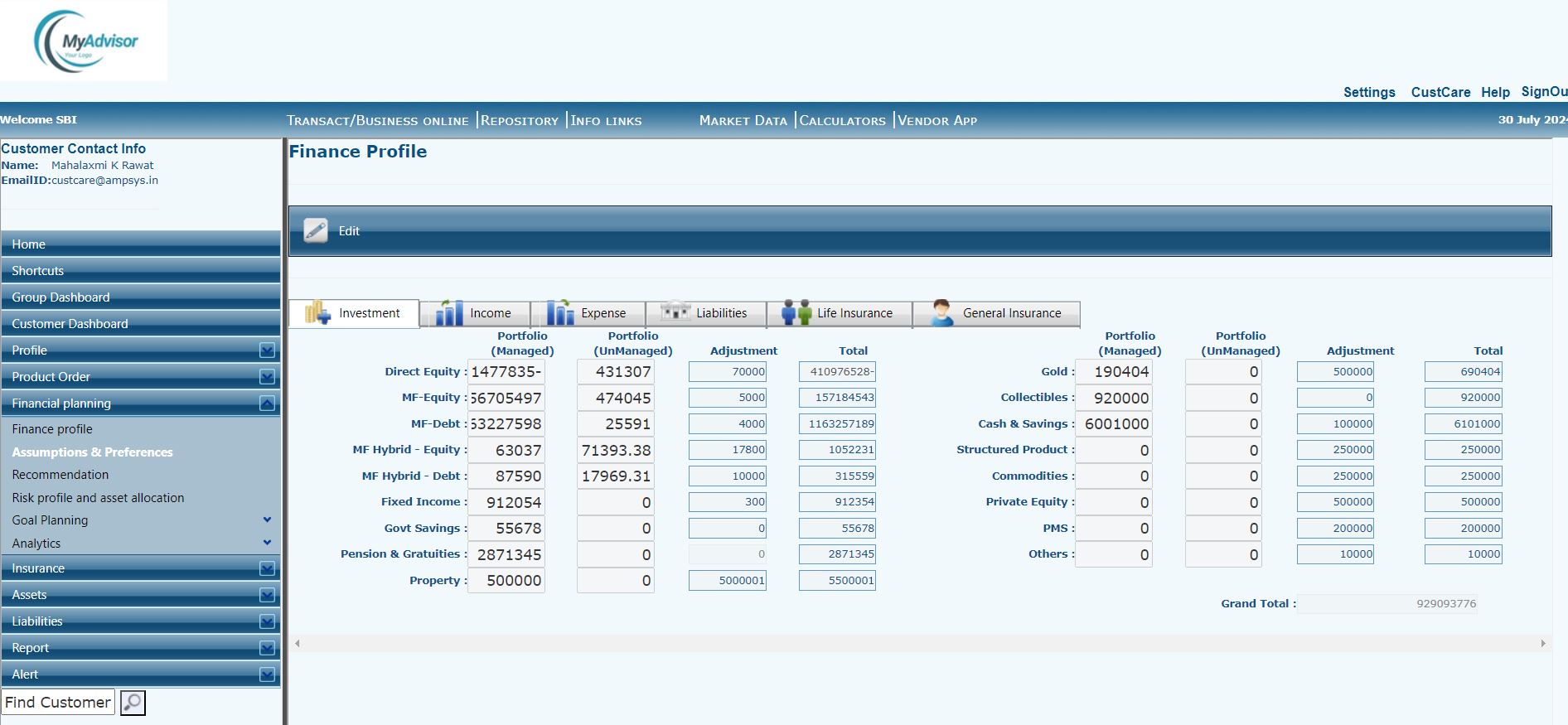

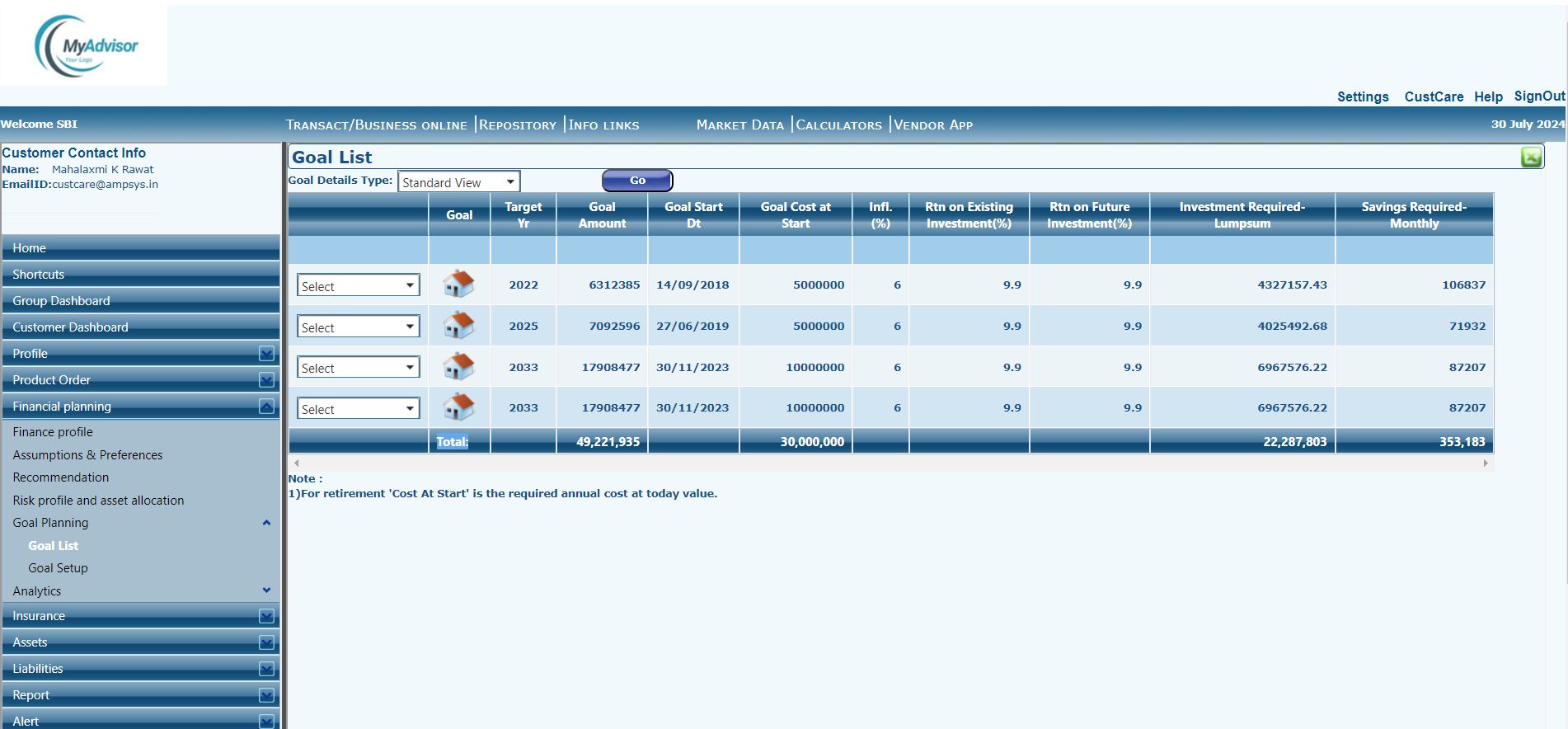

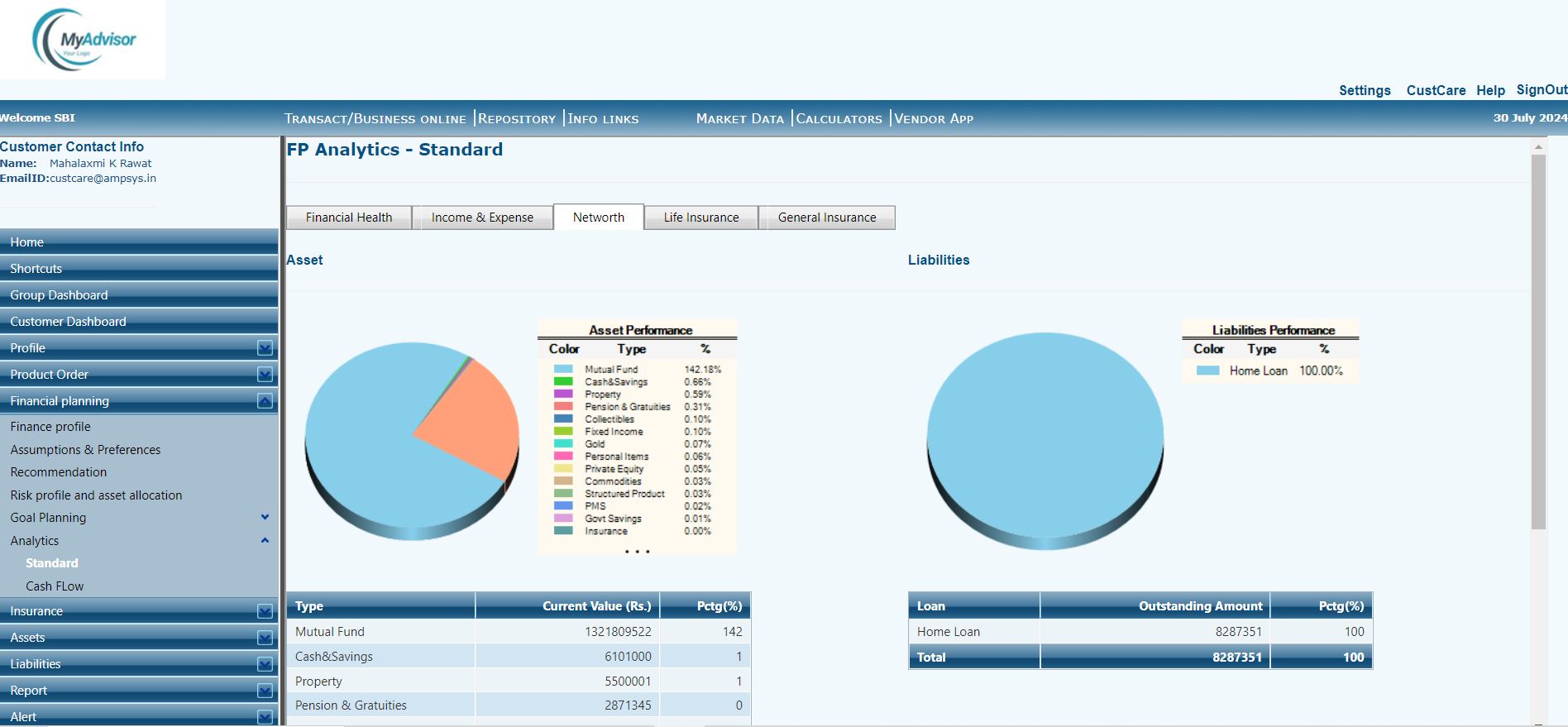

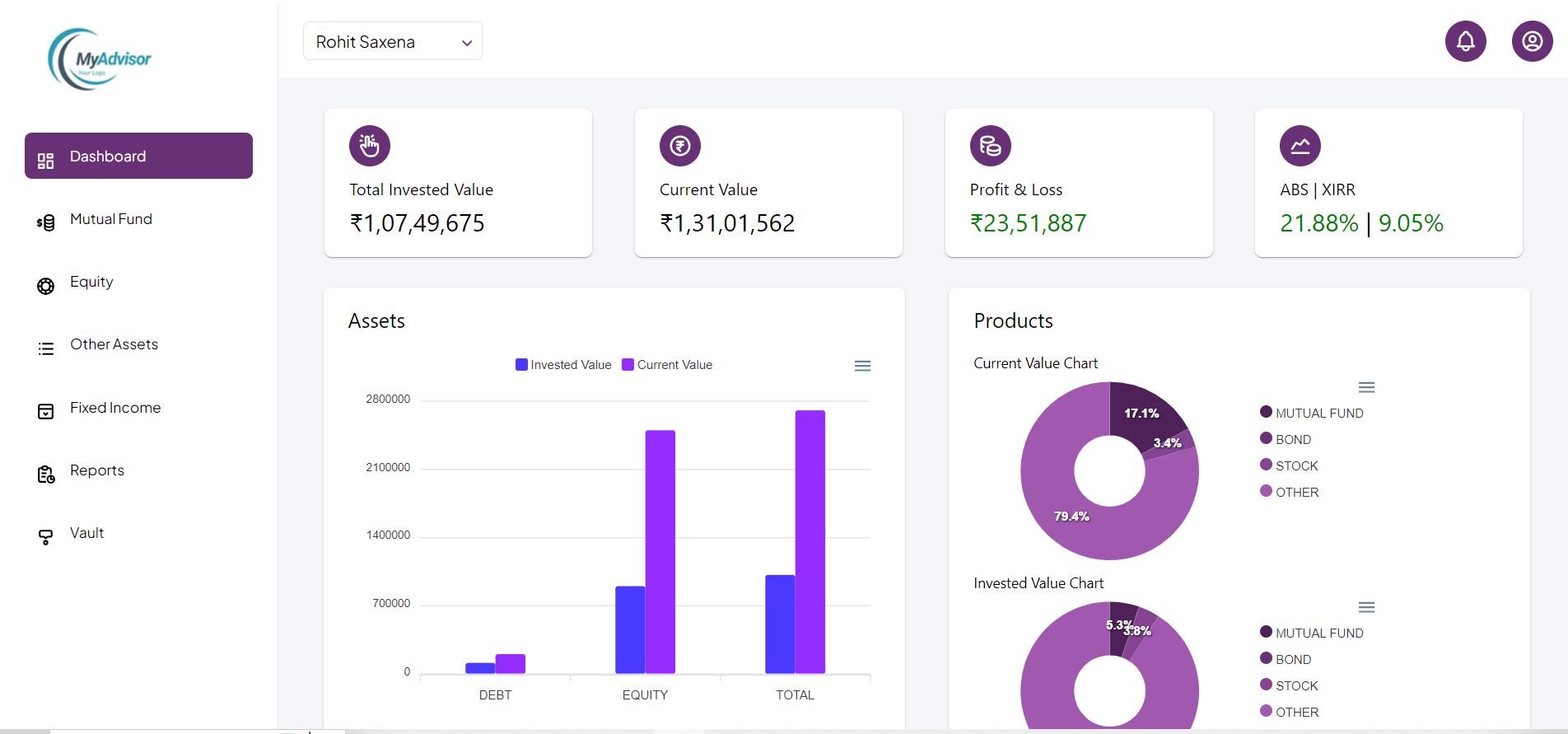

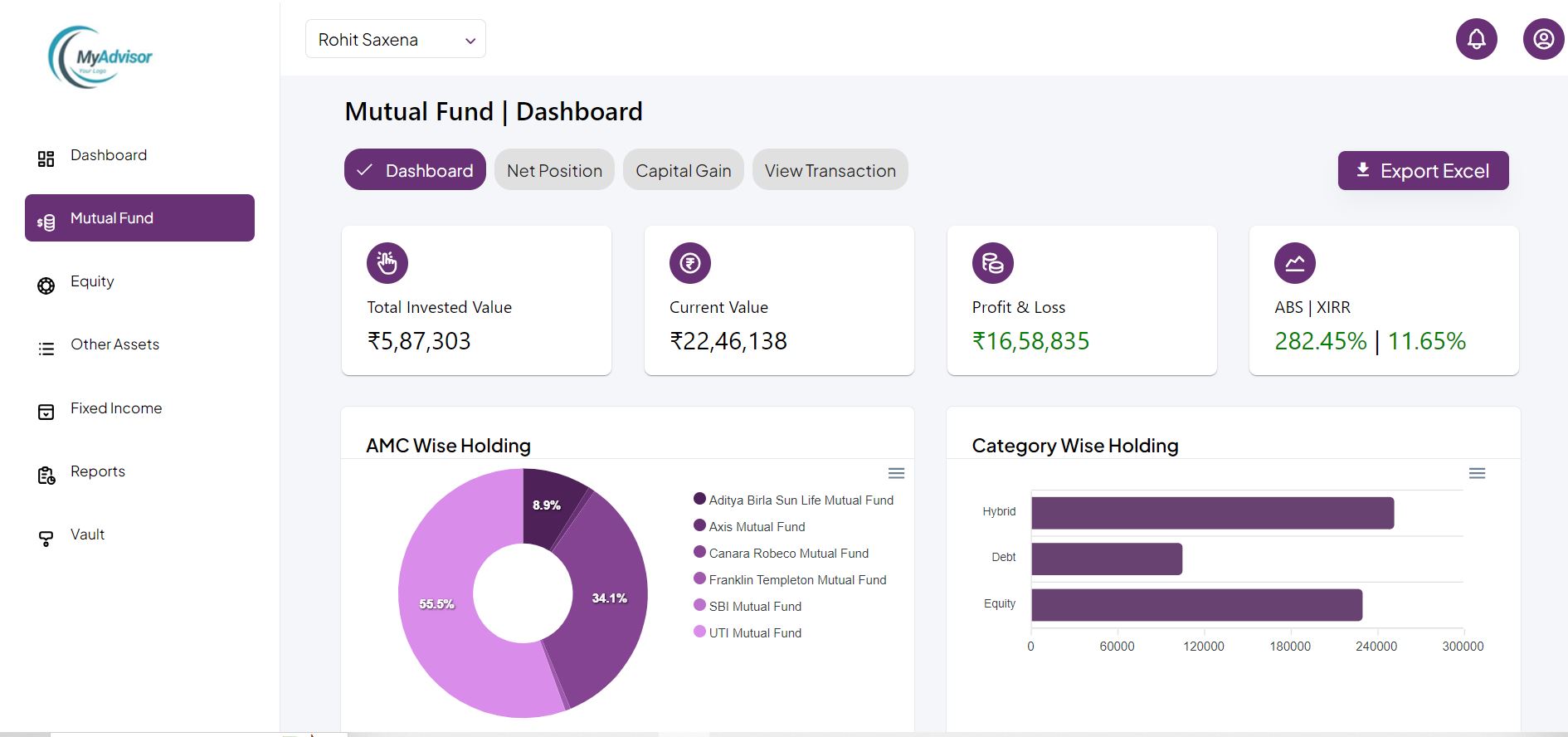

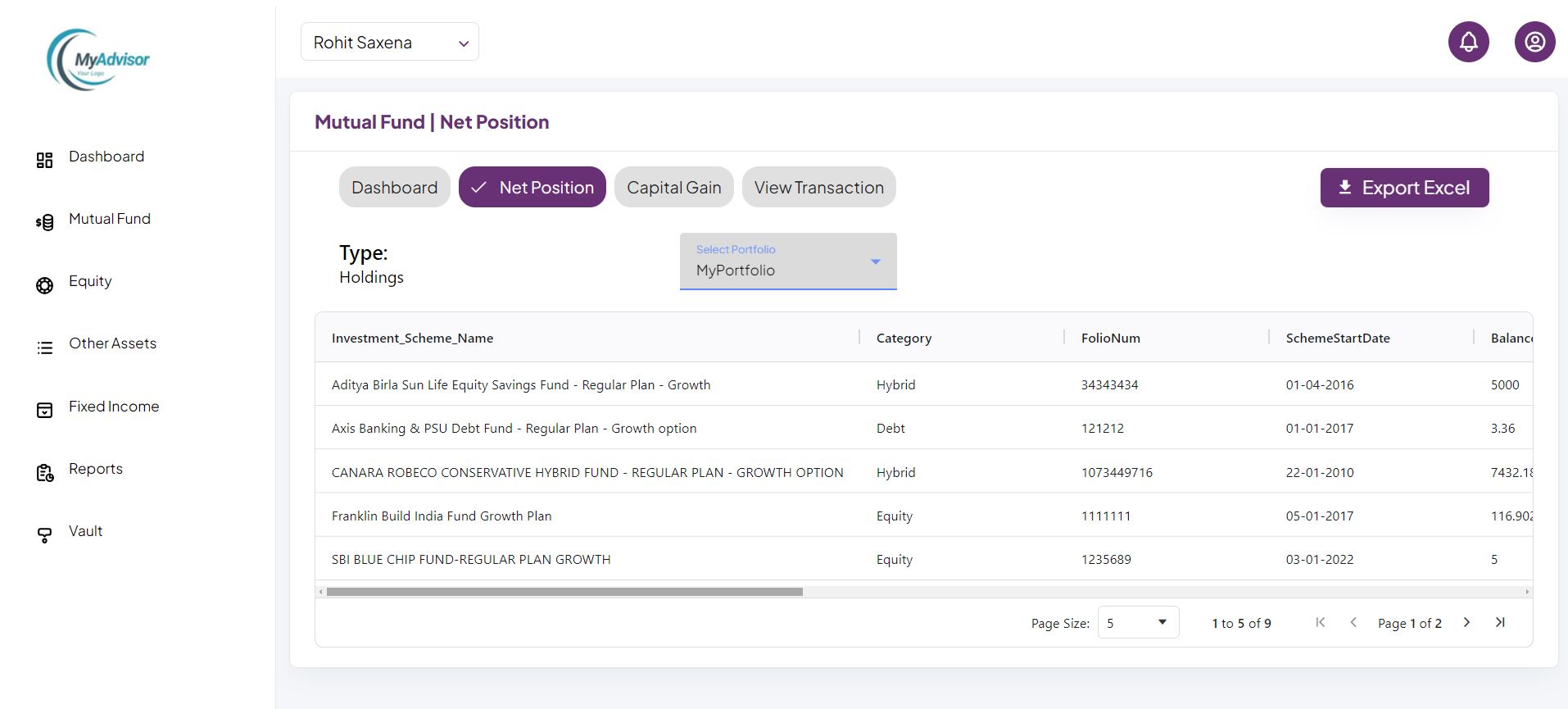

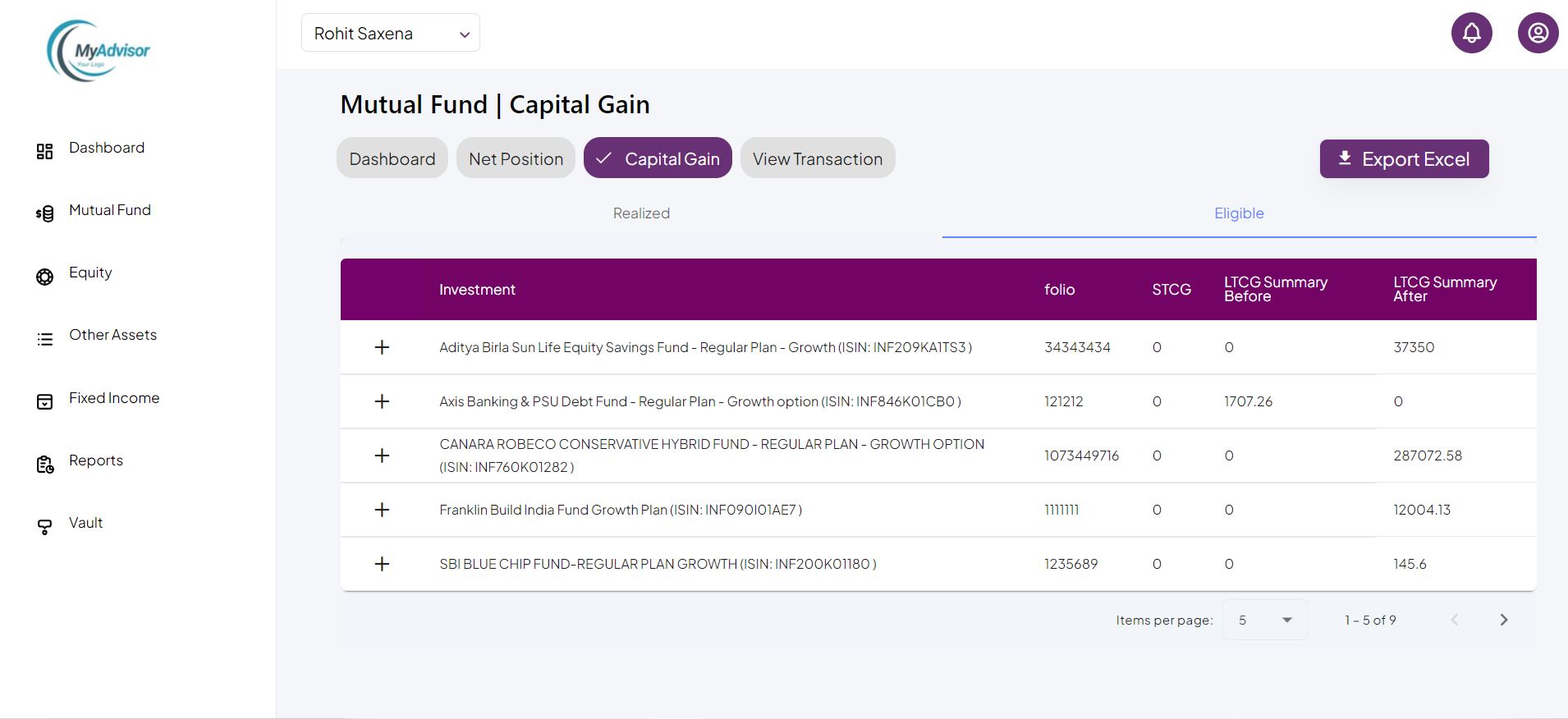

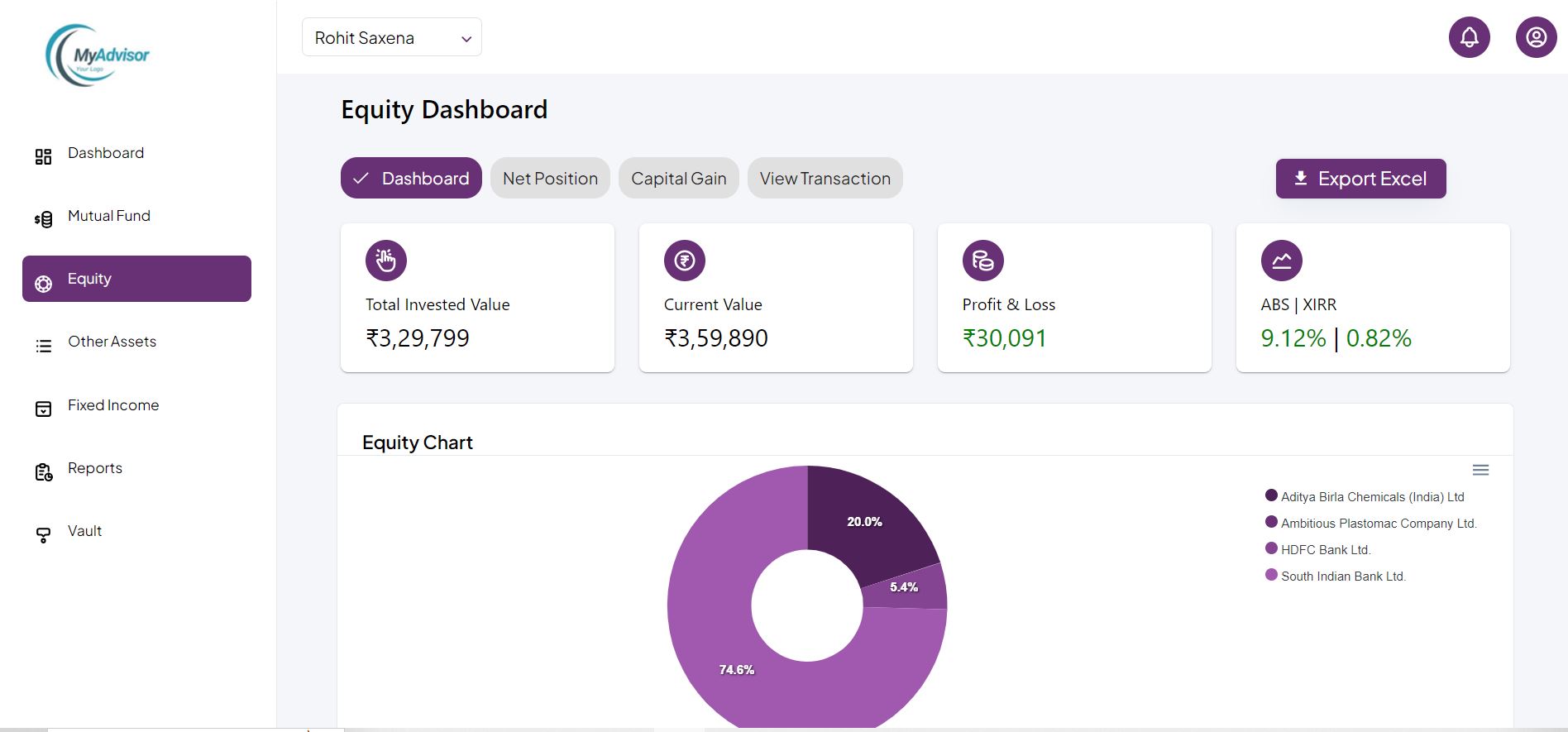

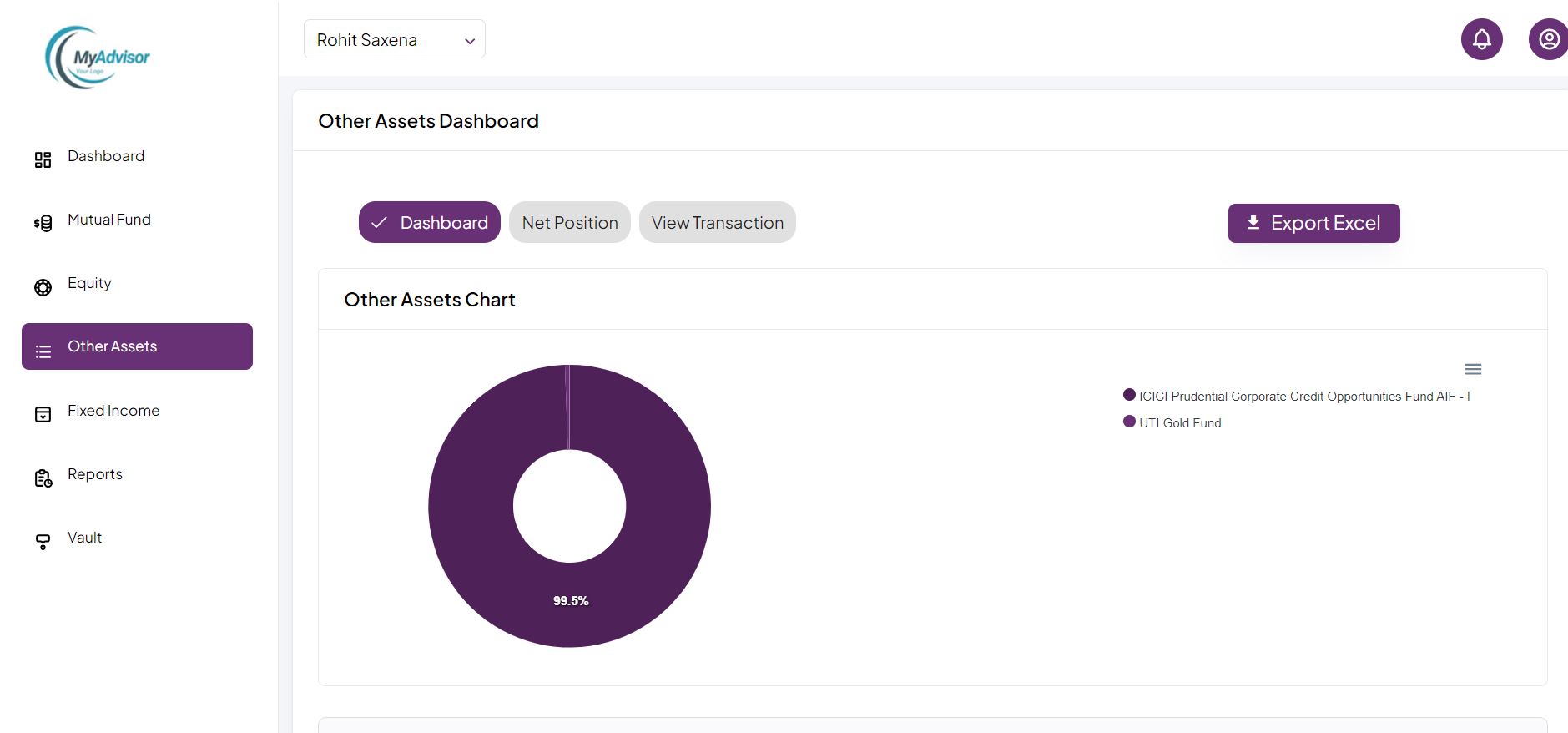

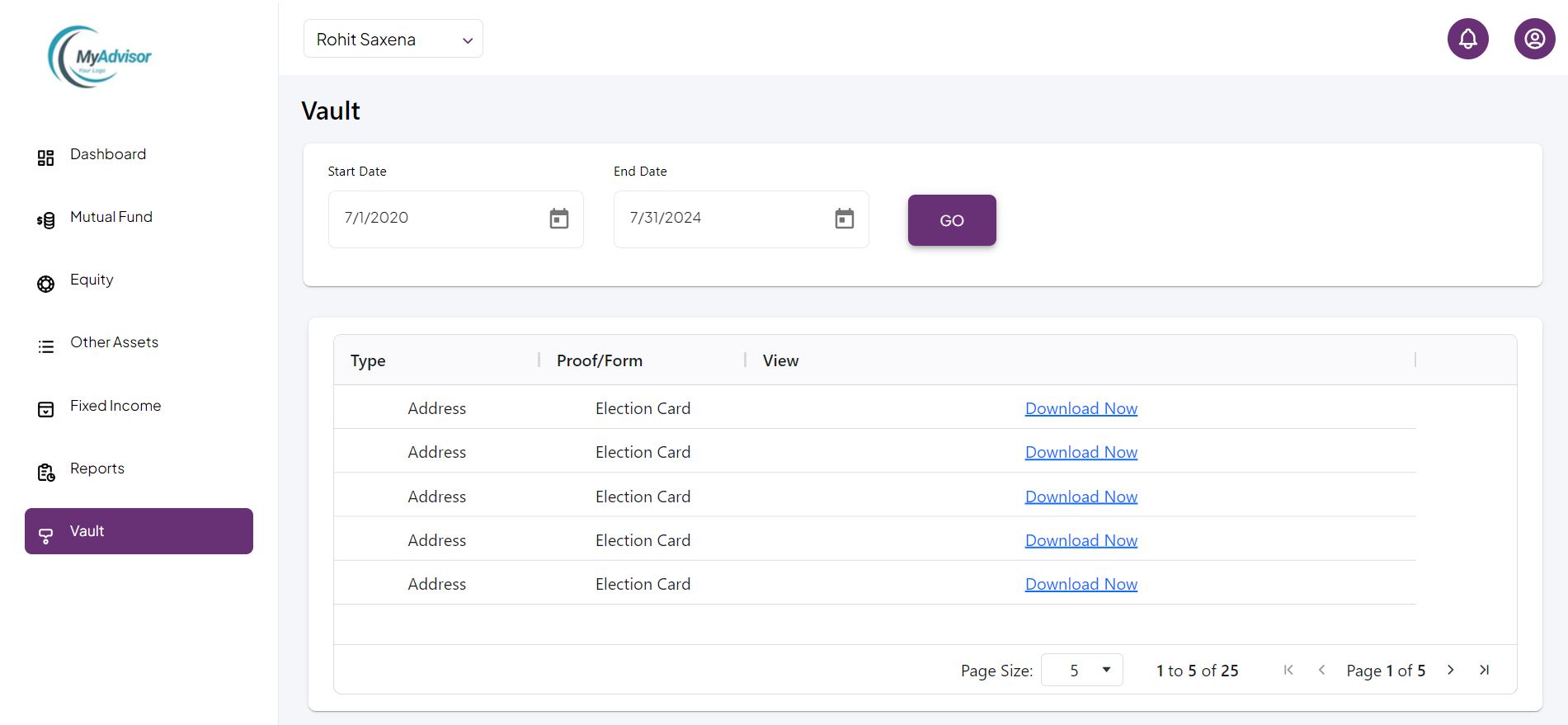

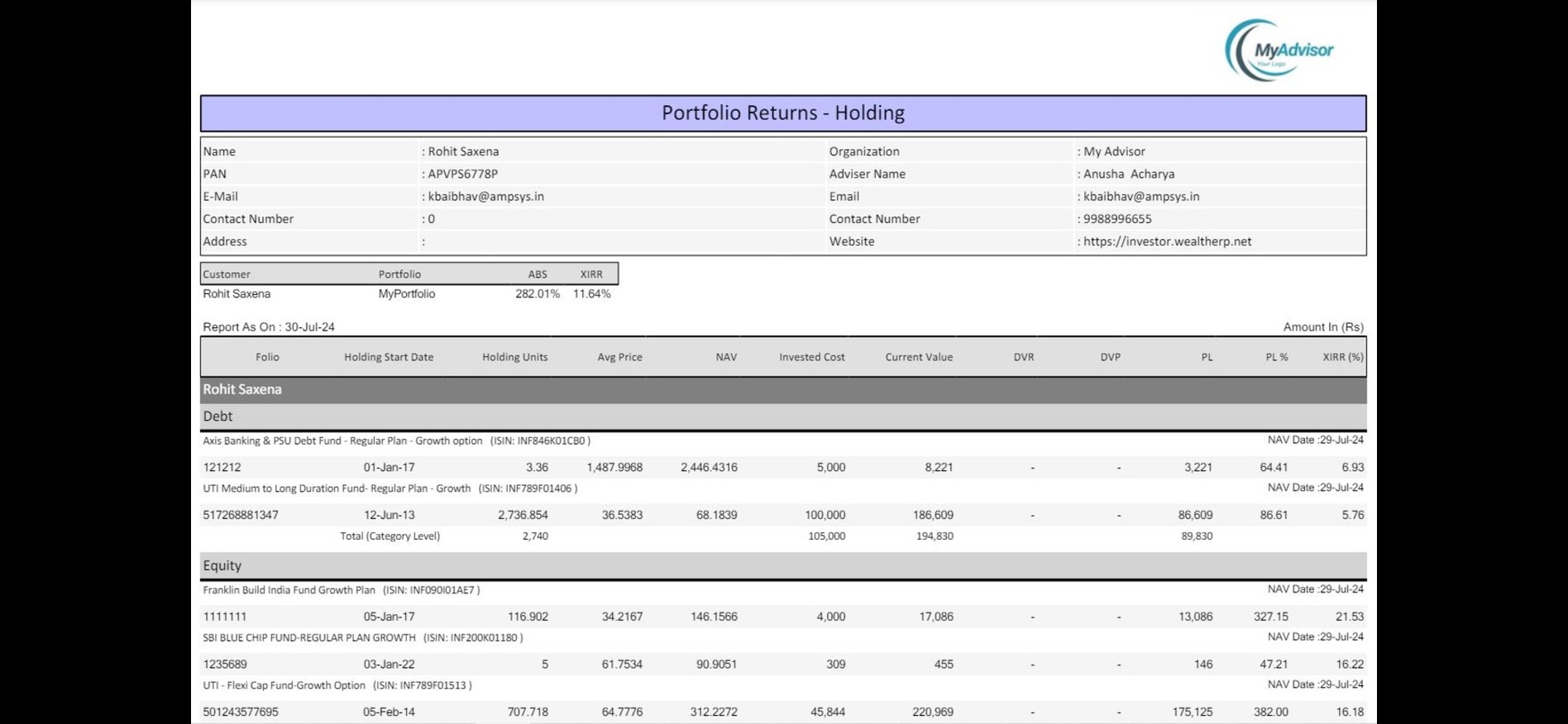

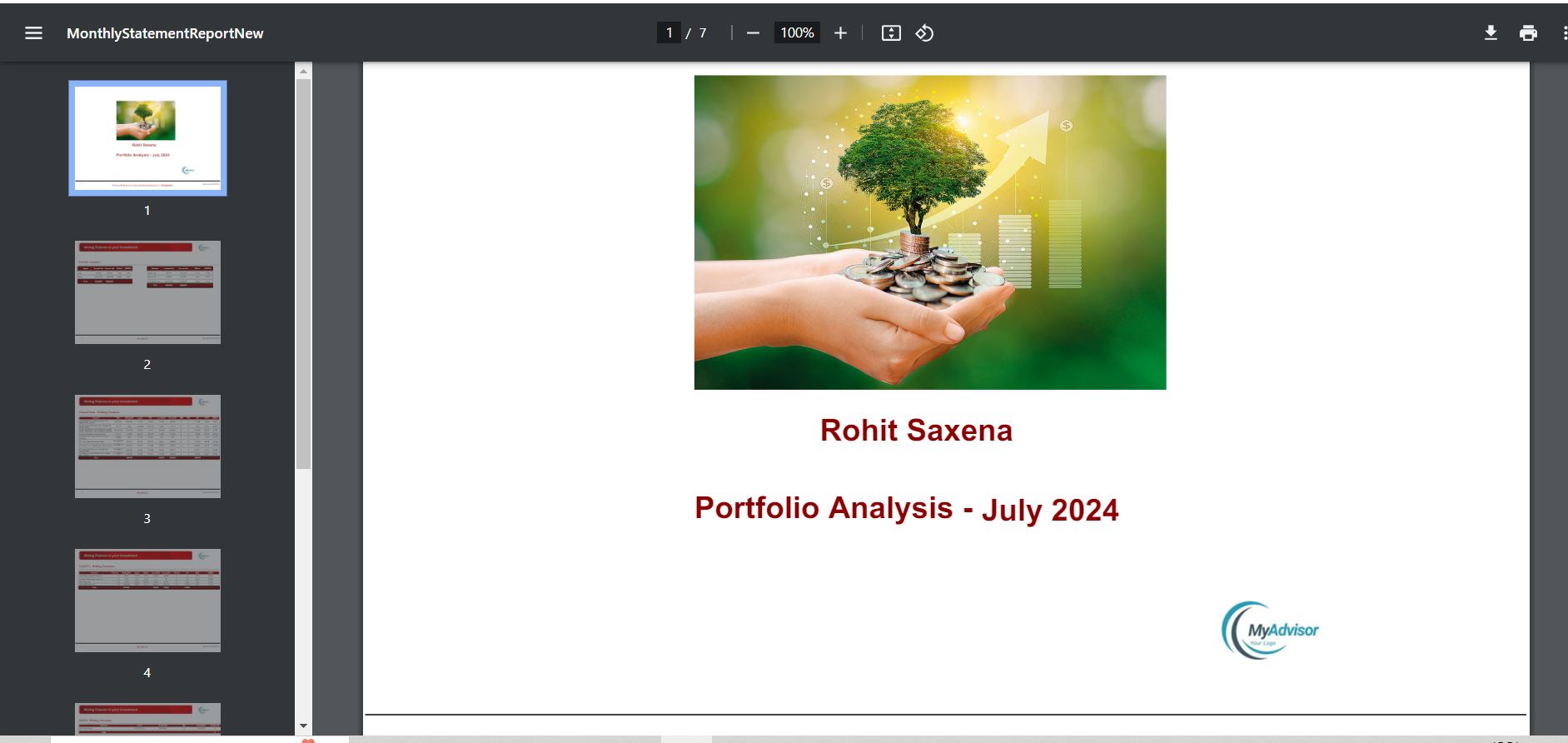

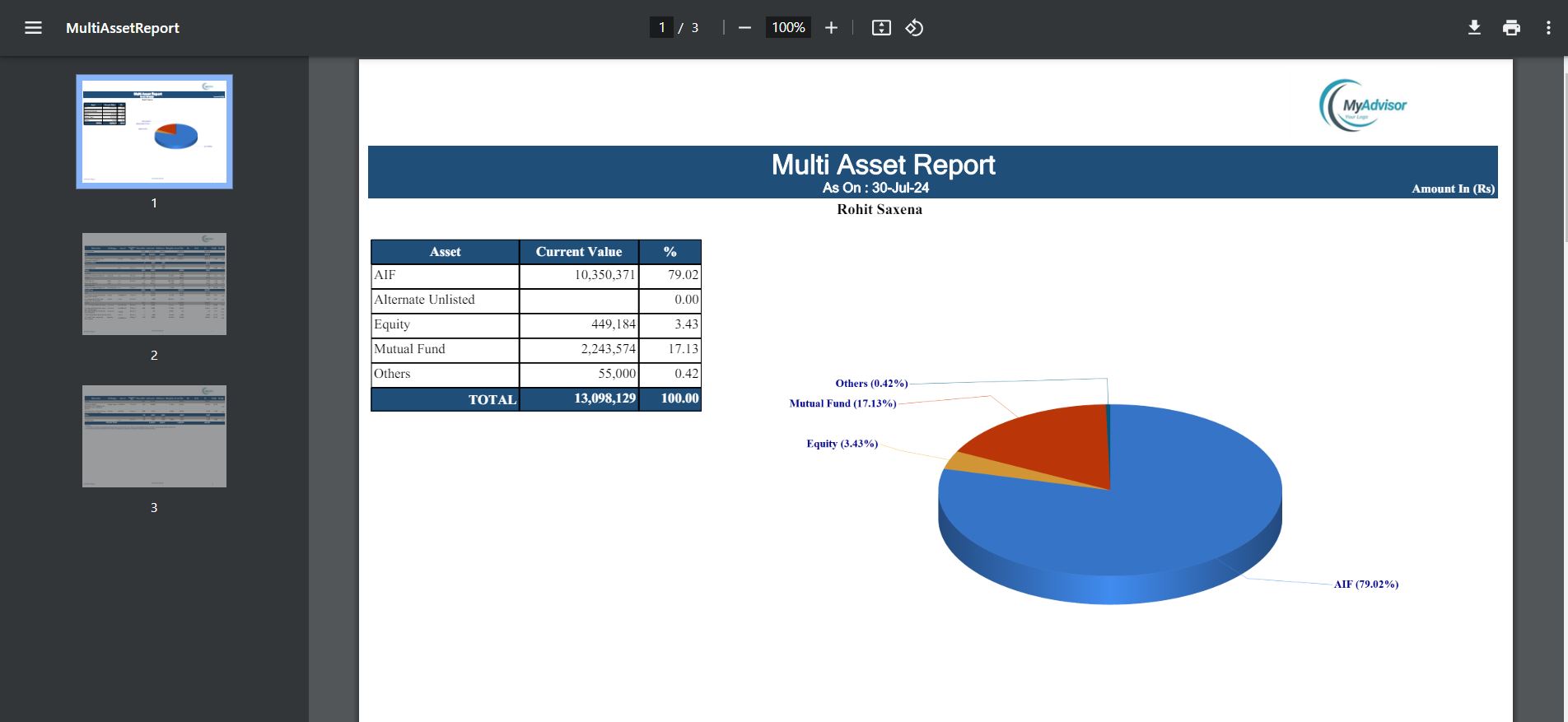

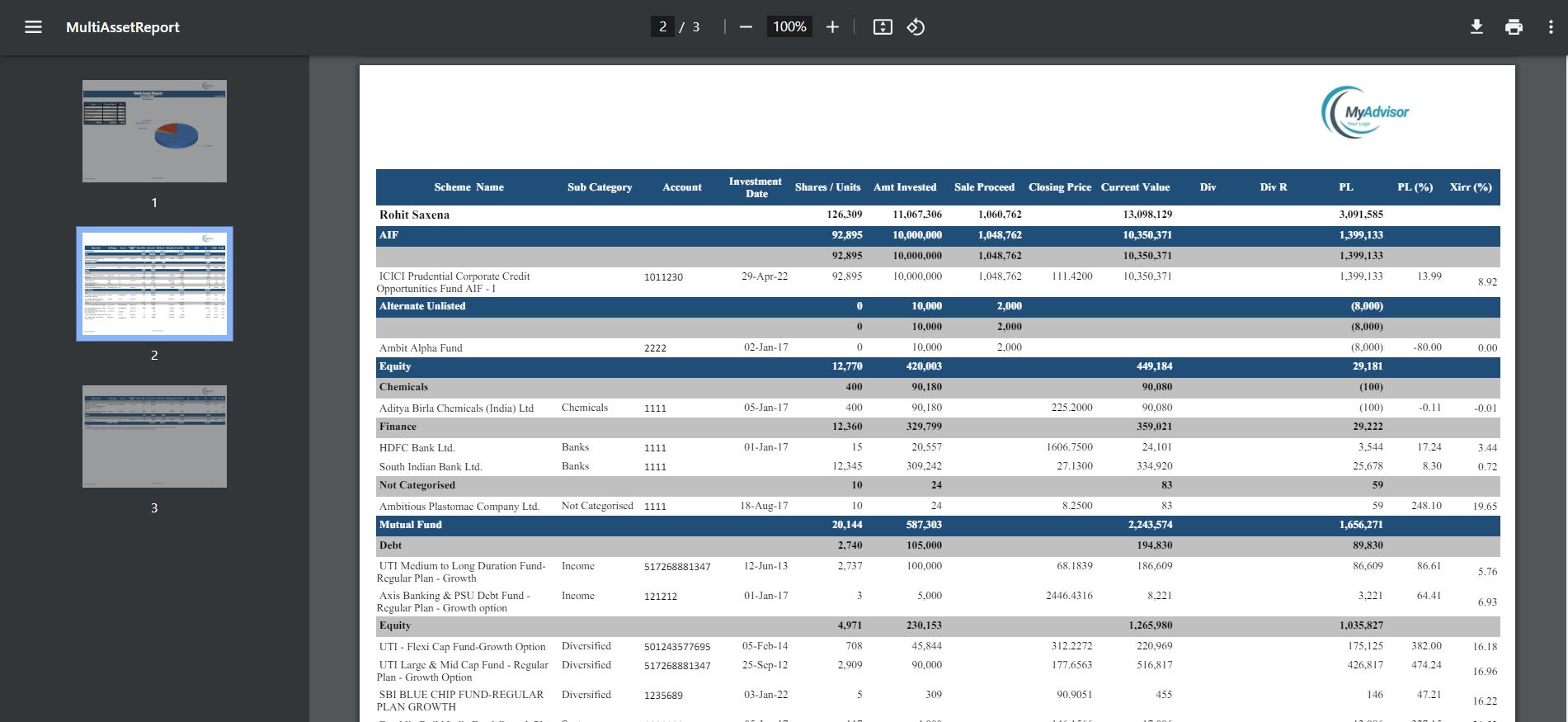

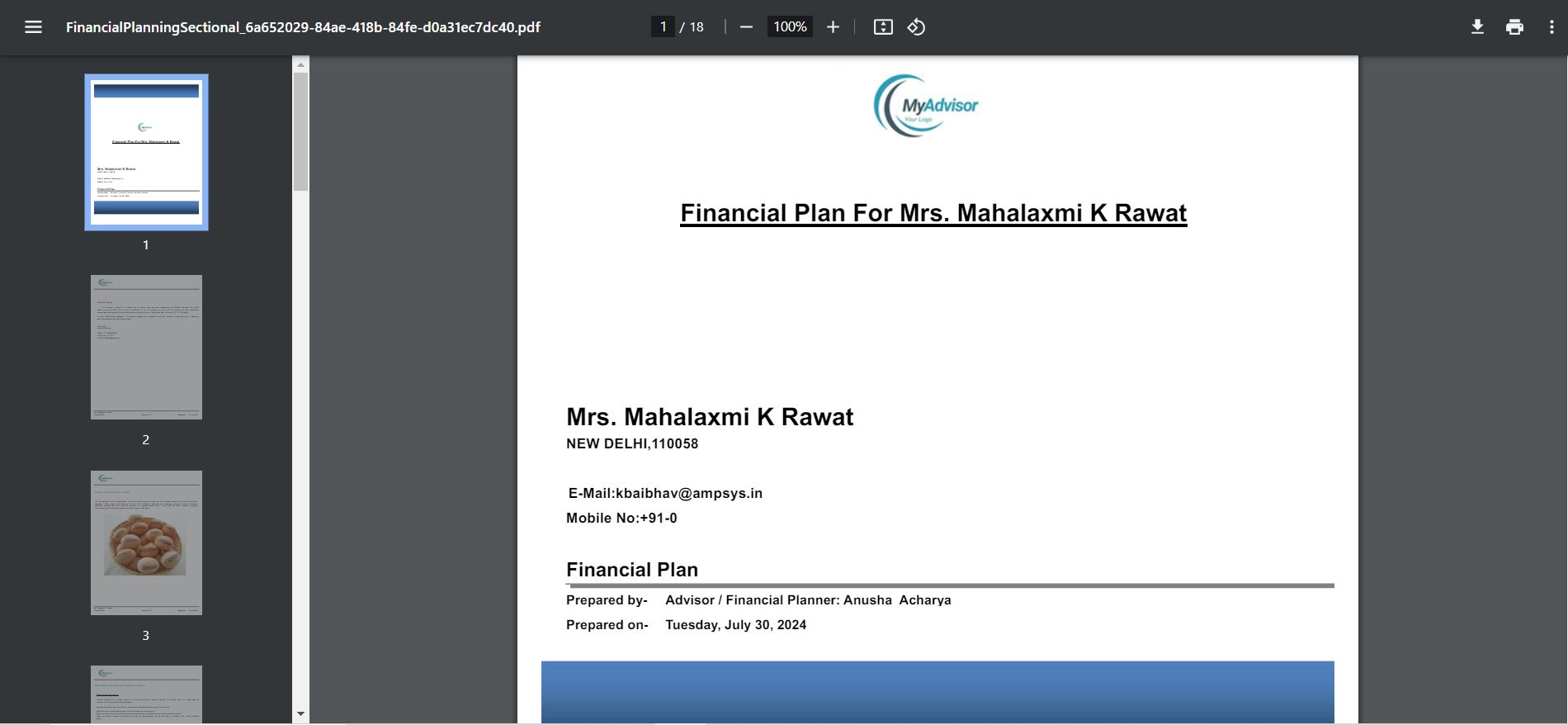

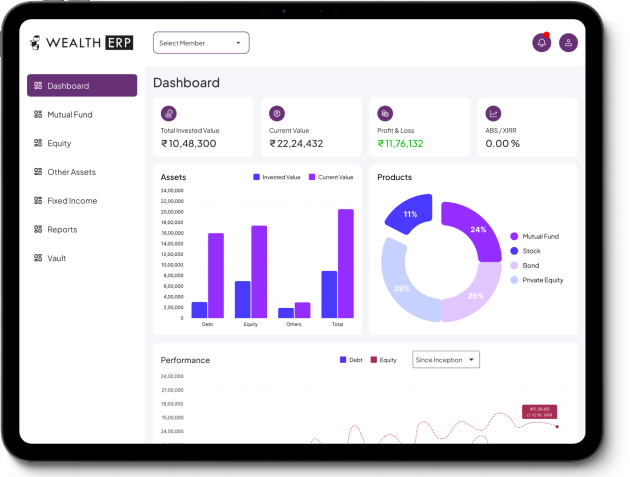

Centralize all client investments in a single platform

WealthERP is a cutting-edge wealth management SAS

product hosted in a state-of-the-art, ISO 27001 certified,

and SAS 70 Type II audited Level 3 Internet Data Center,

ensuring top-notch security and reliability. This platform

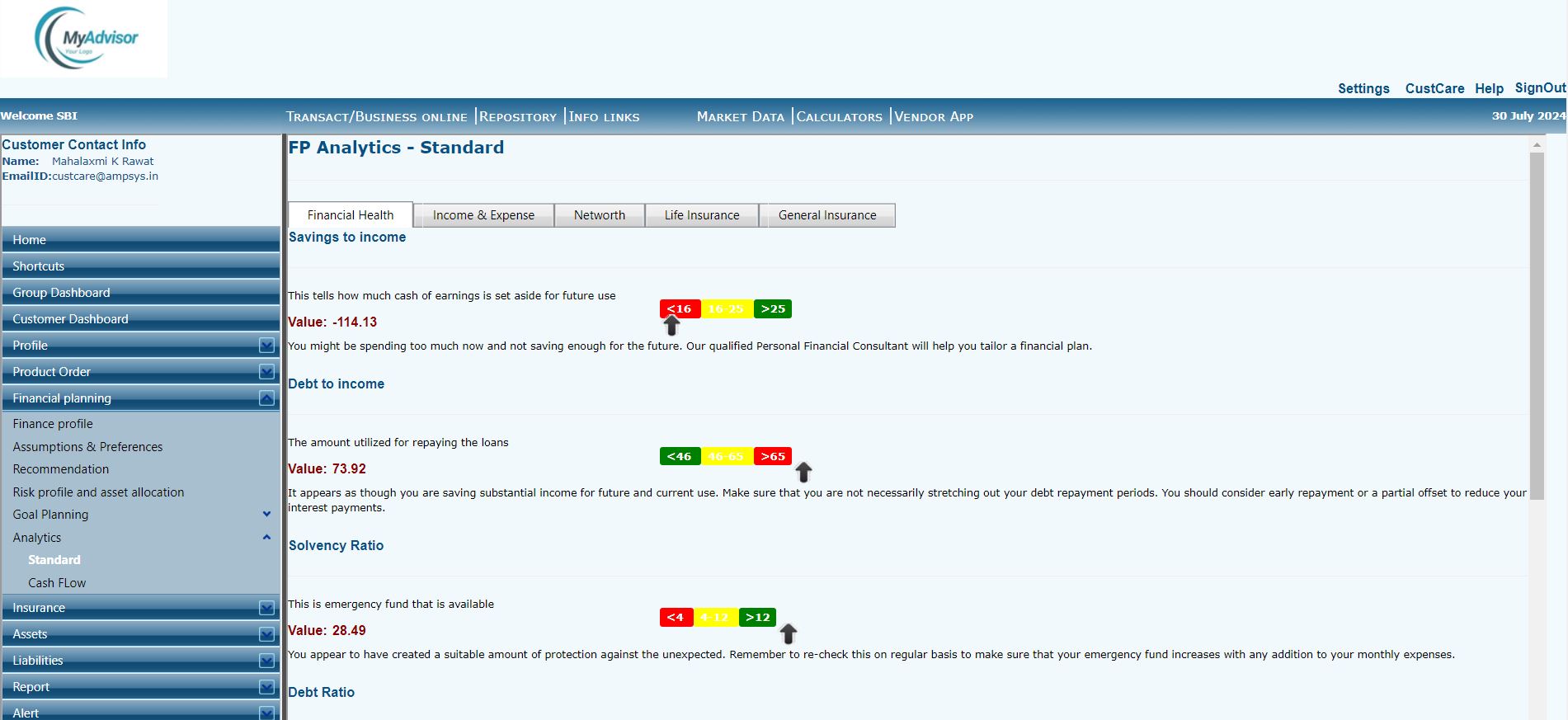

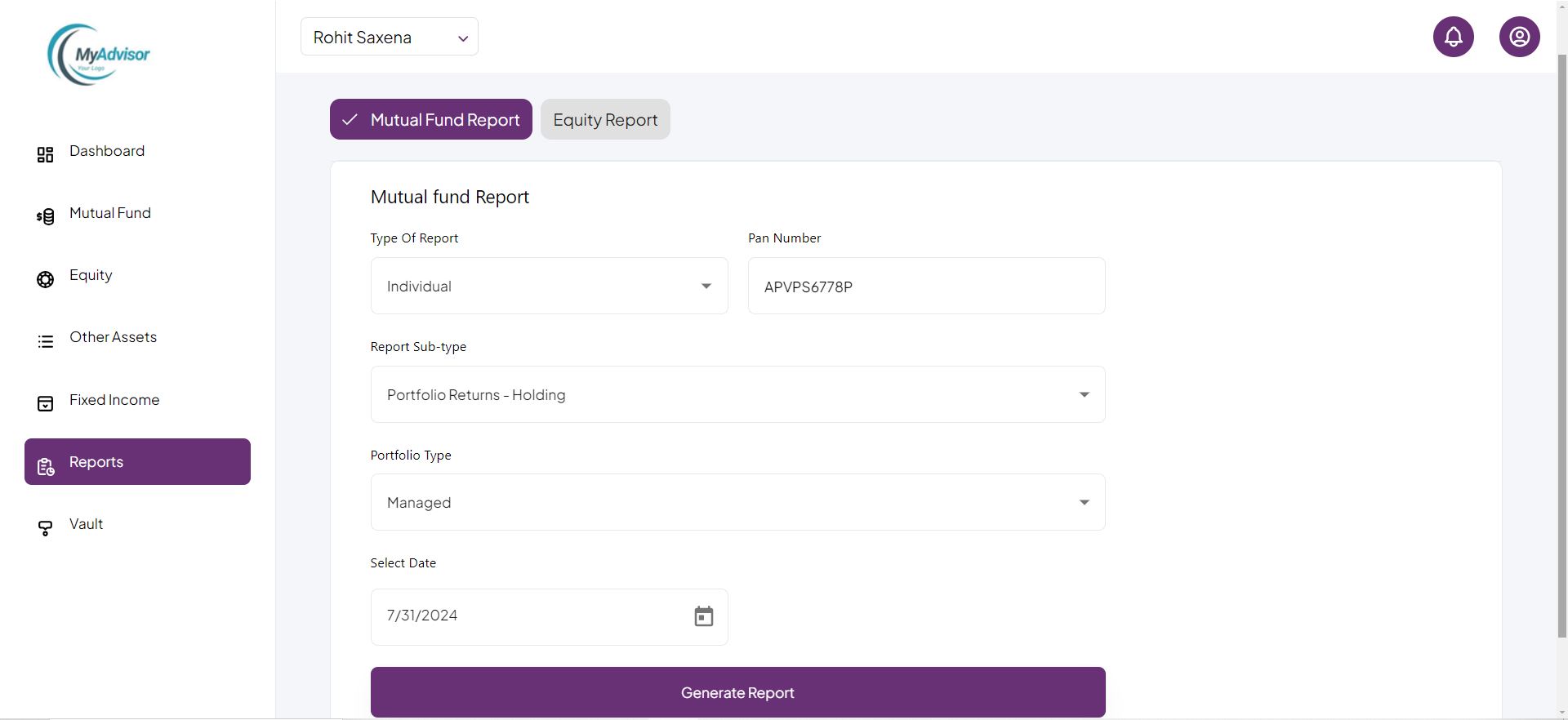

empowers clients to easily compare a variety of financial

products, streamlining their investment processes.

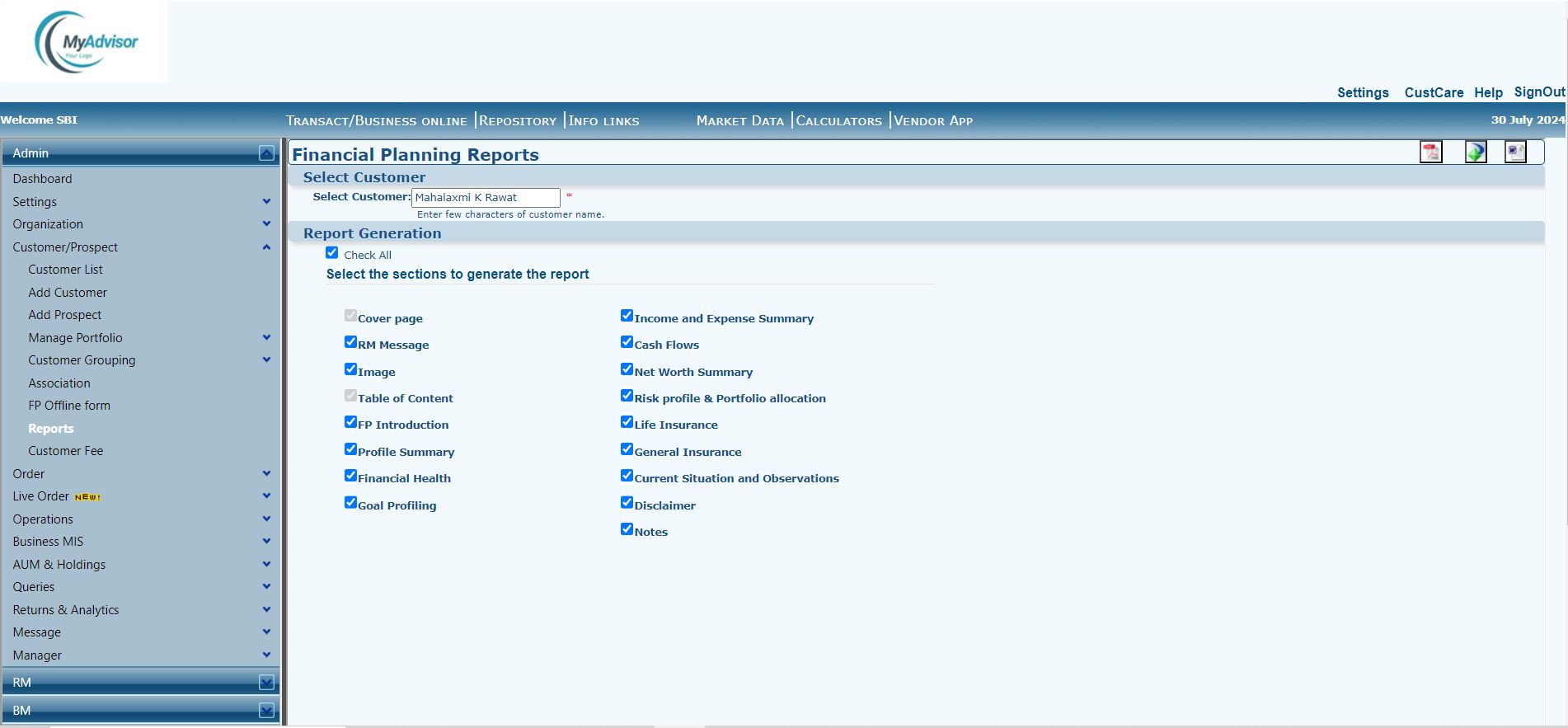

Key Features

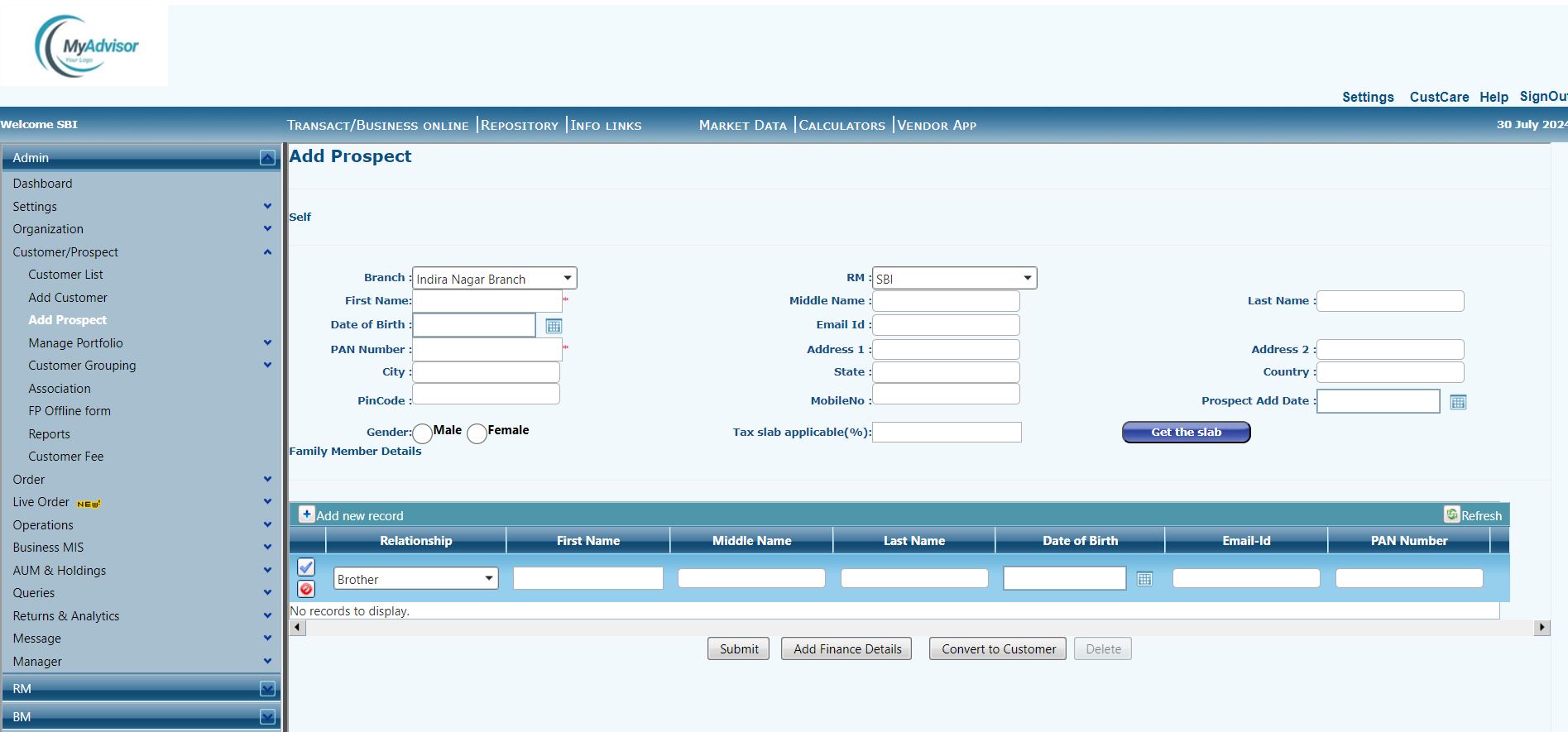

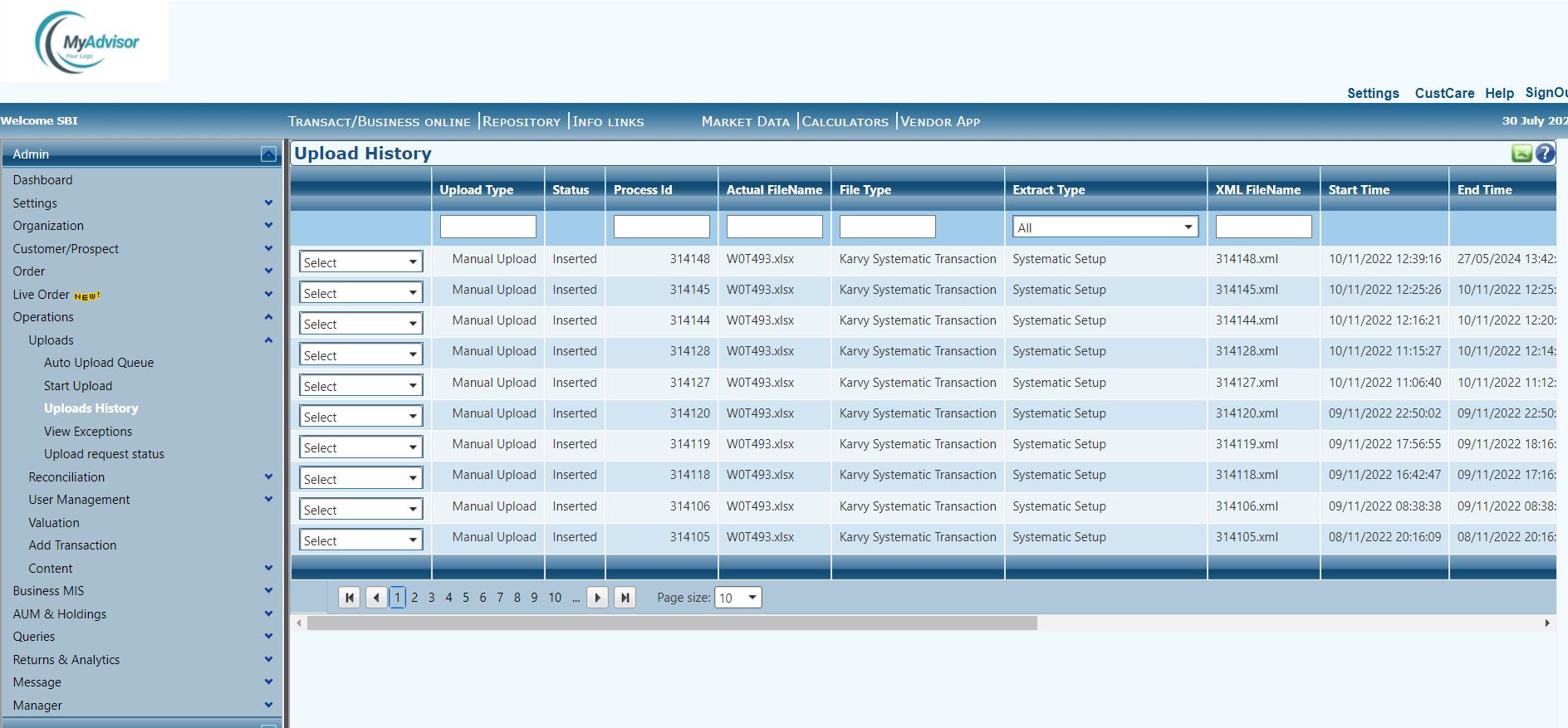

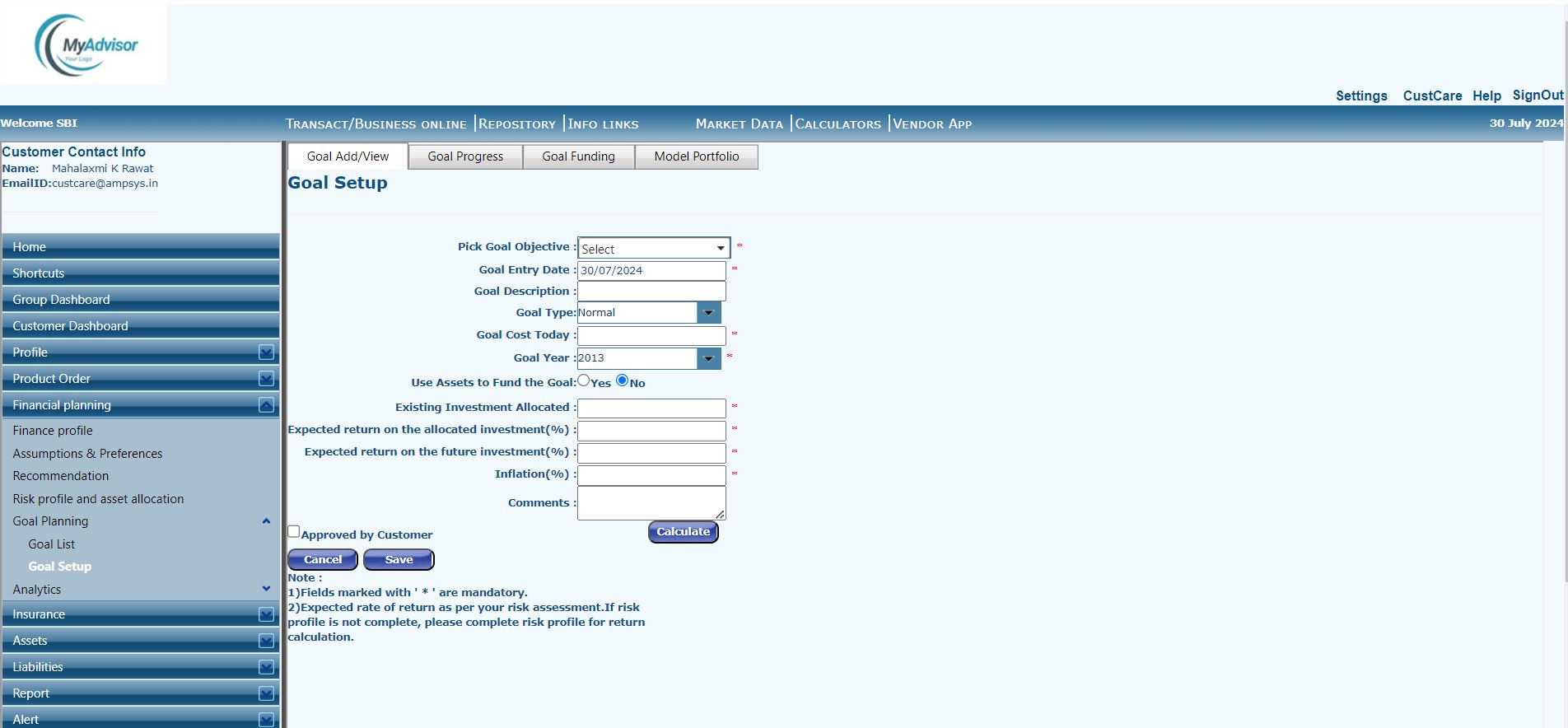

Customizable Solutions Backoffice Support

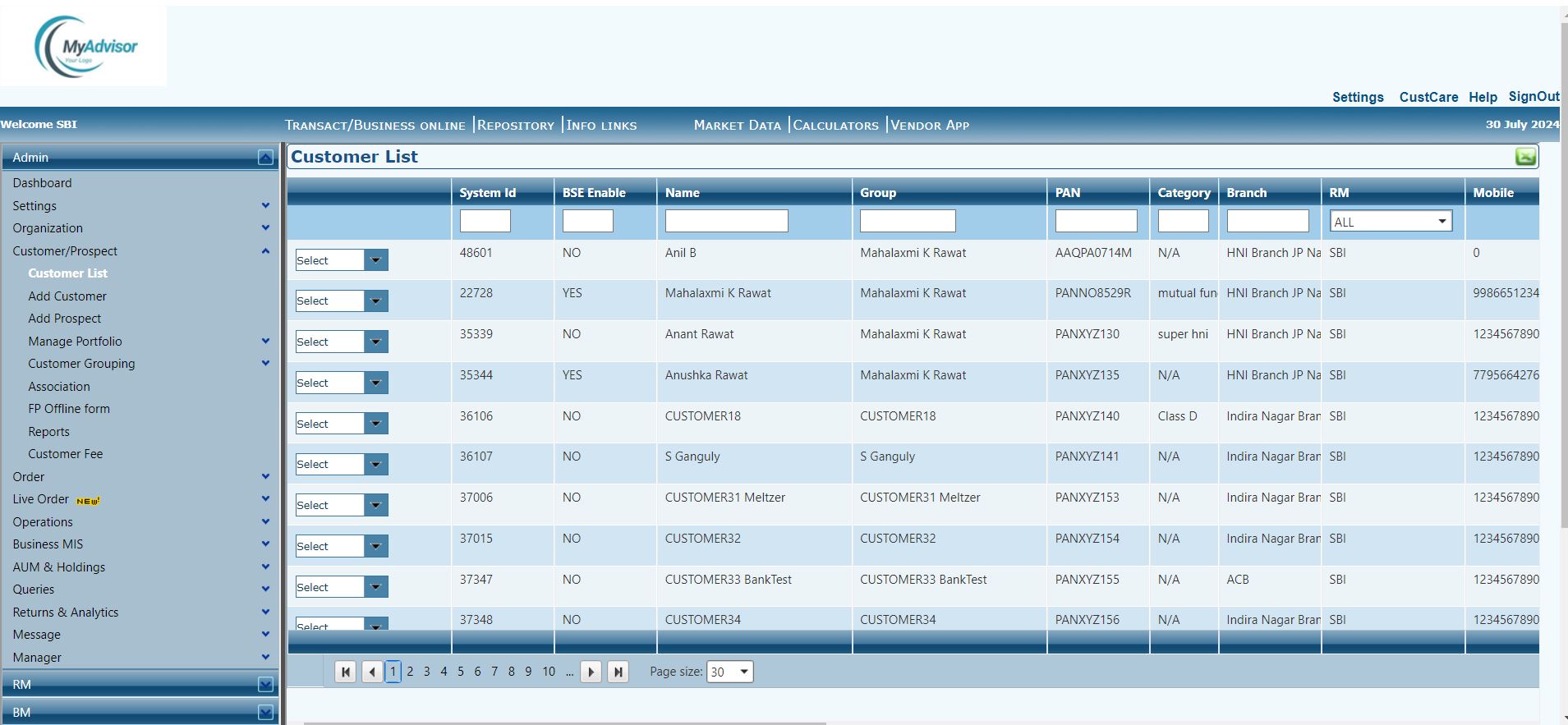

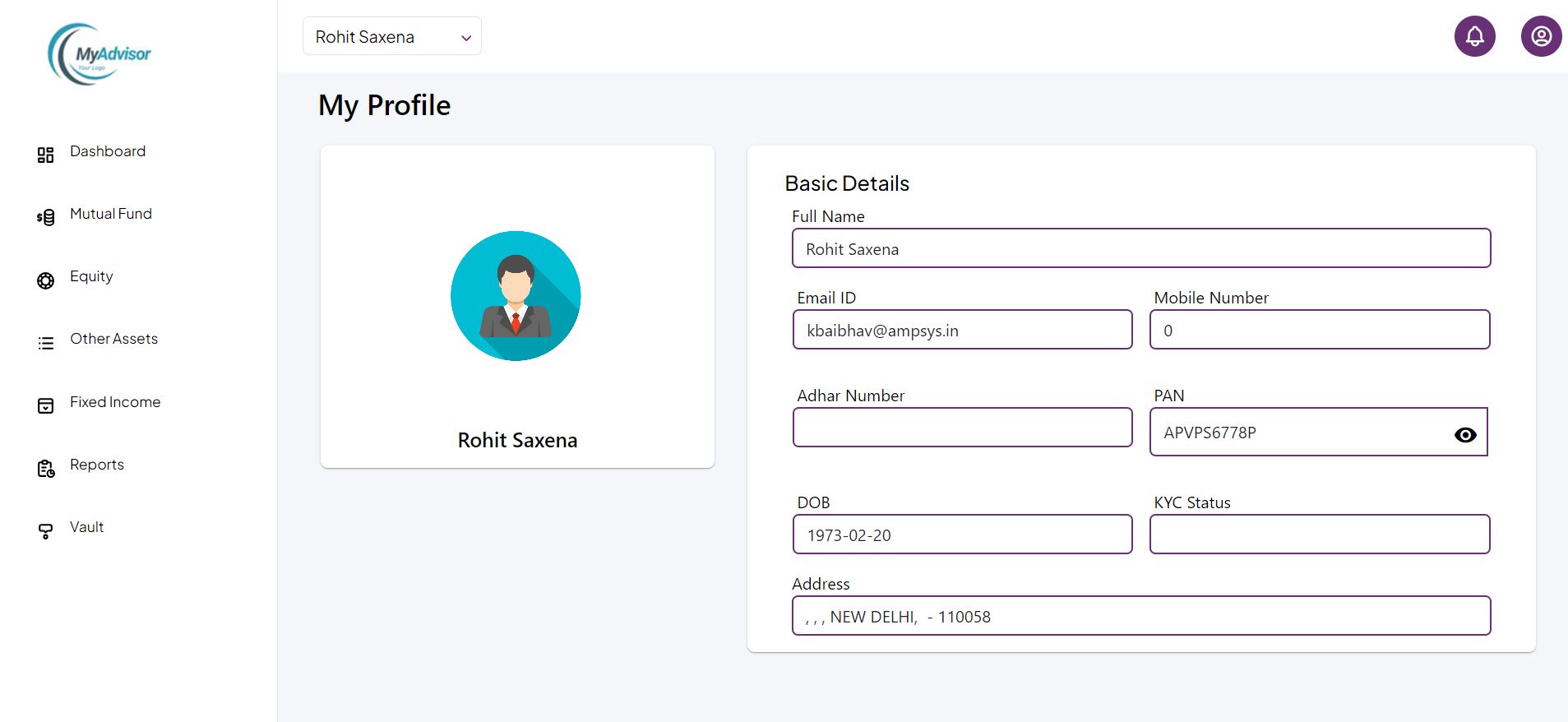

Quick and Scalable Client Management